Six years ago, two unit owners at a York Region residential condo tower invited me to attend their Annual General Meeting.

As a proxy, I attended two AGMs. The only positive thing I could say about the meetings is that the sandwiches and fruit dishes were, by far, the best refreshments I ever enjoyed at a condo AGM. I skipped my dinner before I attended the second AGM, as I wanted to fully enjoy such a luxurious spread.

The meetings were horror shows. The new three-person board were under the spell of the corporation’s lawyer who chaired the meeting and dominated the proceedings by over-talking everyone and hurling insults and slander towards anyone who disagreed with him, or who he thought were on the other side of numerous lawsuits that he handling on behalf of the corporation.

It was like listening to a small-city version of Donald Trump, bluster and all.

The 184 unit building was fairly new and it did have some construction defects. I have no idea how serious these defects were but the lawyer, and the engineer he hired, made it sound like it was the worst built structure created by man since the launching of the Titanic.

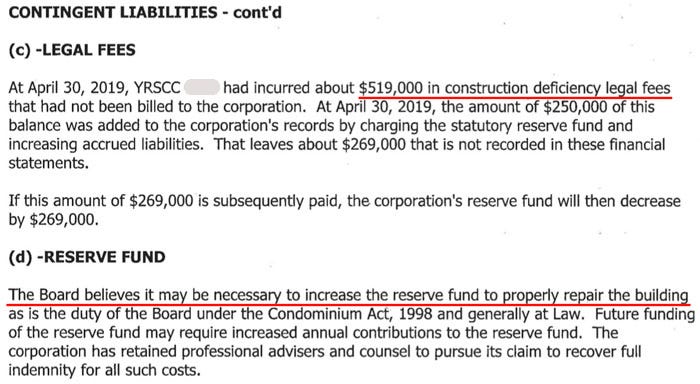

As a first that I know of, the lawyer disclosed that his legal fees for fighting these court applications would be drawn from the Reserve Funds. I found that to be alarming as I deducted that the legal fees would become very expensive.

For the second AGM, the printed and distributed audited financial statements for the previous year had the value of the requested damages in the outstanding lawsuits listed in the billions instead of millions. No one caught this huge error; not the auditor, not the Board president or the treasurer, (who all signed the statements verifying that they were correct), not even the bombast lawyer.

Unbelievable.

Both of my acquaintances sold their investment units.

The passage of time has taken a toll

A few weeks ago, I received a copy of a recent Status Certificate. I found that little of substance had changed in the last five-years.

Status Certificate

The Board had increased in size. An Assistant Secretary and five officers joined the three directors, who have voting rights, on the Board. A nine person board is unusual.

There are 87 leased units, 47% of the total.

None of the original lawsuits were closed. The corporation was not able to agree on the cost-sharing formula with the separate condo townhouse corporation for the shared underground parking garage.

I was surprised to read that the condo had filed an Application with the courts to stop a requisition for a Special Owners meeting that was petitioned by 57 unit owners that consists of 31% of the total ownership.

For a less hardy man than myself, the disclosure that the condo corporation may have to raise the maintenance fees or take on a Special Assessment to pay for major repairs and replacements could have triggered a live-threatening stroke or heart attack.

However, no matter how dangerous it is for the contestants in the ring, the fans watching high up in the bleachers feel safe enough.

2022-2023 Budget

Item 6115, Legal Fees are budgeted at $5,000 for this year even though last year’s legal fees came in slightly higher at $17,353.81, a mere (347%) over budget.

There is no budget for Legal Fees in the Repairs & Maintenance section.

I also saw a new expense: $125,000 for a Loan Payment. Oh my, the condo has taken on a loan.

Audited Financial Statements

The Status Certificate contained the Audited Financial Statements for the year 2019-2020, so it is one to two years old. Issuing dated financial statements usually means bad news. It could also mean that the corporation did not hold an AGM last year.

This time the corporation hired a well known accounting firm to audit the books; one that is experienced in auditing condominium corporations.

The preamble to the report is usually covered in a few paragraphs. This one was different—it took two full pages to state the auditors’ concerns. I never saw anything like this before.

Have any of you ever saw a statement like this in a preamble before:

“Misstatements can arise from fraud or error…”?

I was especially taken back by their opinion that “future events or conditions may cause [the condo corporation] to cease to continue as a going concern.”

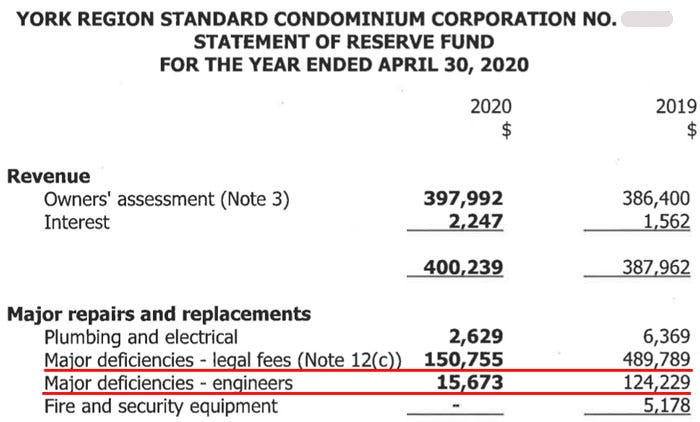

The condo corporation paid about $519,000 in legal fees that came out of the Reserve Funds.

While we are focused on Legal Fees, see that in the previous year, the Operating Funds paid out $23,328.

Looking at the Reserve Funds, in just these two-years, the condo corporation spent $640,544 in legal fees and & $139,902 in engineering fees for a grand total of $780,466.

Don’t worry about where the money is coming from to pay for this. The Status Certificate states that the corporation took out a loan with Morrison Financial

for $1,750,000.

The icing on the cake

CMHC has no insured mortgages in the entire building. A building where every mortgage could be insured, has no insurance, is suspicious as it suggests that CMHC does not believe in the building..

The bottom line

Units in this corporation do sell. Very few people know how to read a Status Certificate and since they hire the most inexpensive real estate lawyer they can find, the lawyer isn’t paid enough to take a good look through the paperwork and far too many Realtors need the commission, so the purchasers don’t get much help from either of them.