'I have until next week': Toronto condo owner facing $40,000 bill for new windows

CTV News Toronto (abridged)

Pat Foran

13 August 2024

When Bonnie Jones bought her first condo five years ago, she thought aside from her mortgage and taxes, the $1,000 in monthly maintenance fees would cover all other costs associated with her condo unit.

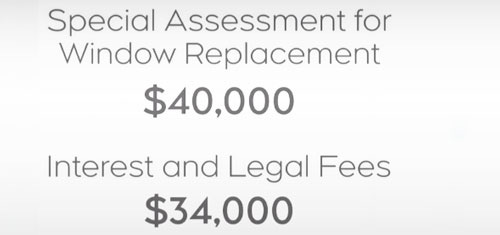

That’s why she was shocked to get a special assessment to pay an additional $40,000 to replace her windows.

“I have until next week to come up with $40,000 plus legal fees and interest or they are going to sell my condo unit,” Jones said.

Jones sold her house to move into the condo and had no idea special assessments existed and said her windows currently don’t leak and are not scheduled to be replaced this year.

After Jones reached out to CTV News Toronto she said she's been able to make payment arrangements with her building to pay a portion of the money owed and now hopes to pay the remaining amount in the future so she can remain in her condo.

If you're buying a condo, it's important to check the status certificate to see the state of the building's finances and you should also check to see if there are any lawsuits or special assessments pending.

I am singing my old, old song; as I am a has-been one-hit-song entertainer. All condo owners need to read CondoMadness. Sure it’s dated but it is still a very good basic manual on condo living. Three lessons here:

One

Always have money, thousands really, put away in safe liquid assets for any of life’s emergencies.

It could be a serious medical condition, your car gets wreaked in a bad accident, you get laid-off or fired or you home gets completely gutted by fire. Worse yet, you are hit with a special assessment.

I lived in China for a while and I have good Chinese friends both in China and here in Ontario. The average Chinese save 40% of their income. They are ready for life’s emergencies. (They also save up to pay their child’s tuition when they go to university.) In Canada, we think we are doing good if our credit cards are not on their final warning.

Two

Never ignore a letter from the Board saying you owe money. Never. See above how a $40,000 expense ran up to $74,000. This owner made arrangements to pay in installments. Not everyone is so lucky.

Three

"It's important to check the status certificate to see the state of the building's finances.” This is really useless advice.

Most people cannot understand a status certificate, nor can they read the auditor’s financial statement. They don’t know anyone who can read it for them. The real estate lawyer isn’t going to do it as your not paying for much more than getting a title search.

'No one has $70,000 dollars lying around': Toronto condo owners facing massive special assessment

CTV News Toronto (abridged)

Pat Foran

03 October 2024

The owners of a North York condominium say they are facing a $70,000 special assessment to fix their building's parking garage.

Guo said the possible bill is also difficult for him to imagine paying because he doesn’t have a parking spot in the garage.

When CTV News Toronto showed up to the building, other unit holders also expressed concerns about the building’s potential repair costs especially since the building is only seven years old.

“The Condominium’s engineers have advised that water penetration into the concrete garage roof slab poses a serious structural risk which must be addressed. The Board takes this issue extremely seriously, especially in the wake of the deadly 2021 condominium collapse in Surfside, Florida, which was similarly caused. The Board is tasked with ensuring that necessary repair work takes place, even if the difficult decisions it makes are unpopular with owners.”

Days after CTV News contacted the condo board we were contacted again by their legal representative Patrick Greco who said in an additional statement “Construction deficiency repairs are still required. However, upon hearing the numerous questions from owners at last Friday’s town hall meeting, the Board has decided it would be in everyone’s best interests to reschedule the vote to a later date to permit owners more time to review the matter and consider their options prior to voting.”

Same problem, an unexpected special assessment. This time it is $70,000 and the condo corporation is only seven years old. It gets worse. I know that complex as I lived nearby and I watched it getting build.

Did you read: “he doesn’t have a parking spot in the garage”? Half of the owners in that condo corporation do not have a parking spot. However, they got to help pay the repairs to the underground garage.

The Board is going to hold a vote. I assume that the choice will be taking out a long-term loan or going with a series of special assessments. Neither option is ideal.

I figure that the corporation will take out a long-term loan.

Sudden 113 per cent spike in Toronto condo fees sparks nasty dispute and threats

CTV News Toronto (abridged)

Jon Woodward

07 November 2021

When condo fees more than doubled in a North York building, it sparked a nasty dispute involving legal threats, frightening e-mails, and accusations of a conspiracy, according to a new Ontario Superior Court judgment.

And now the board of the commercial units at the Emerald Park condo at Yonge Street and Sheppard Avenue is hoping a new court order against harassment and threats will give some relief — and allow them to get to the bottom of the surprise fee hikes that are common to many new builds in Ontario.

"It kept me awake at night. I couldn't sleep," said William Liu, a member of the board who says he was as surprised as anyone to see the fee hike in the first five years the building was open.

"One hundred thirteen percent on our unit is a lot. For example, my fees went from about $500 a month to about $1,000 a month," he said.

This dispute is with the commercial condo units that are at the bottom of two tall towers at the corner of Yonge Street and Sheppard Avenue. Not much to be said, the builders low-ball the maintenance fees to suck in the buyers and a few years later, when the builder is long gone, reality hits.

'That is the right thing to do'

Winnipeg Free Press

17 July 2024

An addiction treatment centre that only opened last month will move after being told businesses aren’t allowed to operate in the residential condominium development in Linden Woods.

Michael Bruneau, president and chief executive officer of Aurora Recovery Centre, a privately owned drug and alcohol treatment centre north of Gimli, was converting the 23 condo units he purchased at a development at 873 Waverley St., into the Aurora Family Reunification Village, a facility where parents could get treatment while living with their children.

But, now Bruneau says he will be relocating the business after receiving opposition from dozens of condo owners in the rest of the development who said businesses of all types are not allowed to operate there under condo rules agreed to by everyone who buys a unit there—including him.

A condo owner running a small business out of a residential unit is fairly common. I lived in two different condos where owners operated:

• a small insurance company.

• an office for a funeral home.

• music lessons.

• a commercial real estate office.

I also know of condo corporations where owners and renters operated:

• brothels. (both were closed by police raids.)

• meth labs. (one blew up and the other leaked green chemicals into the lower units.)

• commercial take out restaurant food.

• a bakery.

But these were run out of single units, not 23 units.

PwC China in crisis as major clients terminate contracts in wake of Evergrande scandal

A lengthening list of Chinese companies have terminated their auditing contracts with PricewaterhouseCoopers or plan to do so, as the “Big Four” accounting brand faces a crisis over its auditing work for a subsidiary of scandal-struck property developer China Evergrande Group.

PetroChina Co. Ltd. and China Railway Group Ltd. were among the latest to end or decide to end their contracts with PricewaterhouseCoopers Zhong Tian LLP (PwC China), according to the two state-owned giants’ exchange filings released in late May.

PwC’s new China chairman

PwC has tapped veteran partner Daniel Li to be its China and Asia-Pacific chairman, as PwC China’s future in the country remains in doubt due to its auditing work for a subsidiary of fallen real estate giant China Evergrande Group.

The accounting scandal with PwC, one of the world’s biggest auditing companies does inderectly relate to condo corporations. If the biggest auditing companies in the world fake financial records, don’t think the little ones don’t get sloppy.

I went to condo AGMs were one auditor’s financial statements listed a lawsuit in billions instead of millions. Of course, the condo president and the treasurer signed the statements. Did you think that they or the owners at the meeting read the financial statements?

In a couple of other cases, I should have reported three different auditors and one condo treasurer to their disciplinary committee. Only later did I learn, from an accountant that false financial statement are taken very seriously.

I have a chapter for auditing scandals in Condo Madness.